Change in Instalment Plan - CIP

Borrowers of fixed term loans, who wish to change their repayment plan in a P2P environment, must realise that it is a tad unfair to lenders. Lenders have contracted for the fixed term to receive their principal repayment with interest, and if there are any unexpected variations of that, by the borrower, we feel that the lenders should receive some small compensation or, at least, reimbursement for their lost interest. That is fair to both parties! And that is how we have implemented it!

Please note that is no charge for a borrower who wishes to repay their loan in full early, before maturity.

Here is a table setting out the cost to borrowers and the compensation to lenders for CIP:-

Outstanding | Compensation | Borrower |

Loan Amount | to Lenders | Total Cost |

£1,000 | £3.75 | £3.75 |

£1,500 | £4.15 | £4.15 |

£2,500 | £4.95 | £4.95 |

£5,000 | £6.95 | £6.95 |

£7,500 | £8.95 | £8.95 |

£10,000 | £10.95 | £10.95 |

£15,000 | £14.95 | £14.95 |

£20,000 | £18.95 | £18.95 |

£25,000 | £22.95 | £22.95 |

The CIP facility is available to borrowers on any loan where they have made at least one successful repayment according to their repayment plan. This CIP facility allows the borrower to make choices as to how to alter the re-payment instalment plan or to repay the loan in full.

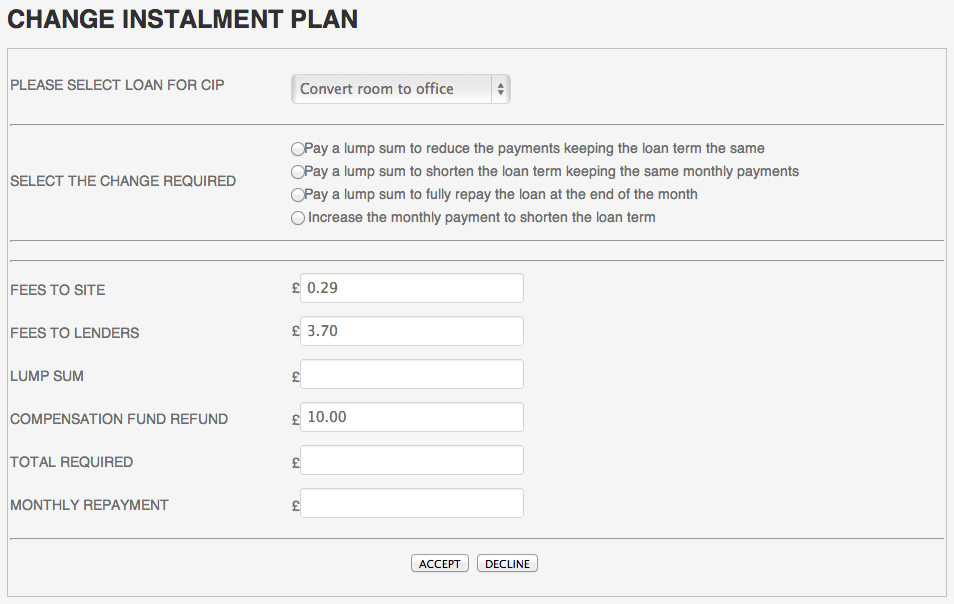

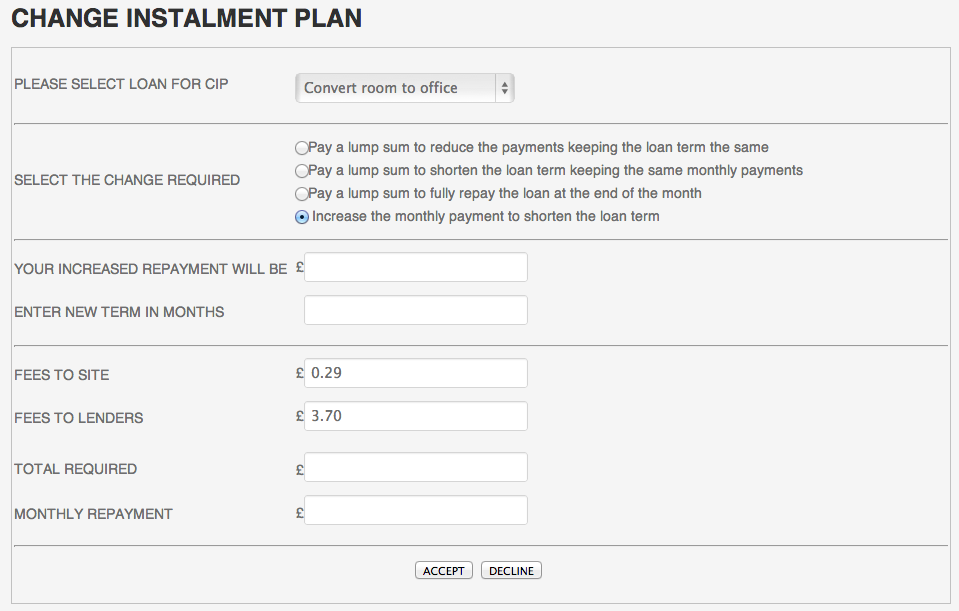

The initial CIP page is shown below. Note that there are extensive tooltips providing explanations on each of the labels and fields e.g. "PLEASE SELECT LOAN FOR CIP":

The borrower is asked to choose from the four options:

| Pay a lump sum to reduce the payments keeping the loan term the same Pay a lump sum to shorten the loan term keeping the same monthly payments Pay a lump sum to fully repay the loan at the end of the month Increase the monthly payment to shorten the loan term |

Depending on the option selected the fields below will change.

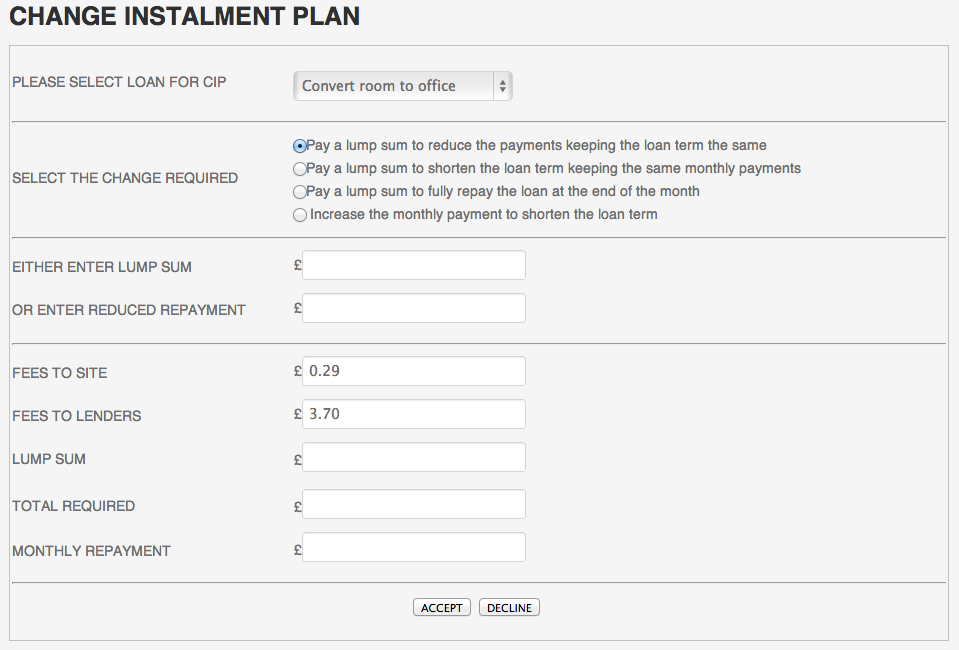

OPTION 1. PAY A LUMP SUM TO REDUCE THE PAYMENTS KEEPING THE LOAN TERM THE SAME

Above,the borrower has the option to either enter a lump sum amount, or to enter the reduced regular monthly repayment. Whichever number is entered the other numbers are calculated.

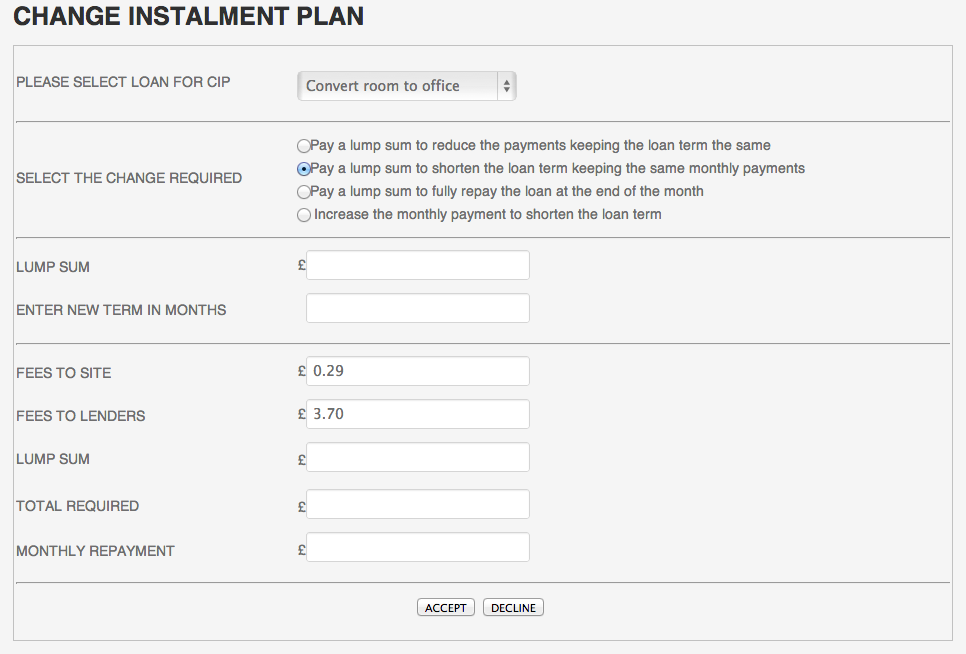

OPTION 2. PAY A LUMP SUM TO SHORTEN THE LOAN TERM KEEPING THE SAME MONTHLY PAYMENTS

Above, the borrower is required to enter the new reduced term of the loan in months and the lump sum required to achieve that change is calculated, with the fees giving the total required.

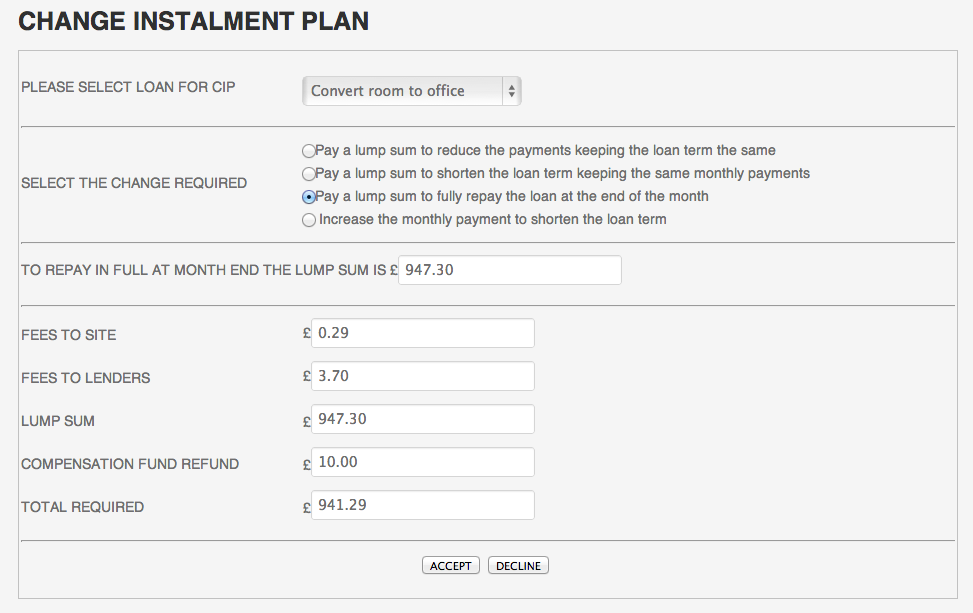

OPTION 3. PAY A LUMP SUM TO FULLY REPAY THE LOAN AT THE END OF THE MONTH

Above, the borrower is not required to enter anything. The required lump sum is calculated along with the fees and the possible Compensation Scheme contribution refund, giving the total required. The Compensation Scheme contribution will only be refunded to the borrower if the loan has never had any late or missed repayments.

OPTION 4. INCREASE THE MONTHLY PAYMENT TO SHORTEN THE LOAN TERM

Above, the borrower is required to enter the new shortened term of the loan in months. The increased monthly repayment required to achieve that change is calculated, along with the fees, giving the total required.

If the borrower clicks “ACCEPT” then the “TOTAL REQUIRED” amount shown needs to be available in the Borrower’s account. If it is not then a message saying “You have £xxxxx.xx available in your account. To make this change you need £xxxxx.xx. Please fund your account.” If the amount is available in the Borrower’s account, then the following happens:-

- All the payment history and repayment schedule for this loan is preserved up to date.

- The new instalment repayment plan is calculated and installed from today going forward.

- Site fees (if applicable) are debited to the borrower and credited to the Site Fee Account.

- Lenders’ fees (if applicable) are debited to the borrower and credited to all the lenders pro rata to their individual investments, and

- The lenders will be credited with their monthly principal and interest instalment repayments resulting from the lump sum payment, according to the new plan.

For anything other than full repayment the Borrower is then routed to “Setting up a Direct Debit for making Loan Instalment Repayments”. The original unpaid DDs for this loan repayment schedule are all cancelled. The new Repayment Instalment Plan Direct Debits are set up.